Buying and selling a house: The full process

Help!!!! how do we do it? Whats the process

The process of simultaneously buying and selling a house can be quite complex. The dreaded property chain can often lead to chaos, causing last-minute complications. In this article, we will explore the various steps involved in this process and provide tips on how to ensure a smooth transaction.

In an ideal scenario, you would be able to sell your current home as soon as it hits the market and then take your time to find your dream home, while your buyers patiently wait for you to move. However, in reality, it often involves buying and selling a house simultaneously, which creates a housing chain. While this is not uncommon, property chains can be a source of headaches. Therefore, if you are considering buying and selling a house at the same time, it is crucial to be well-prepared.

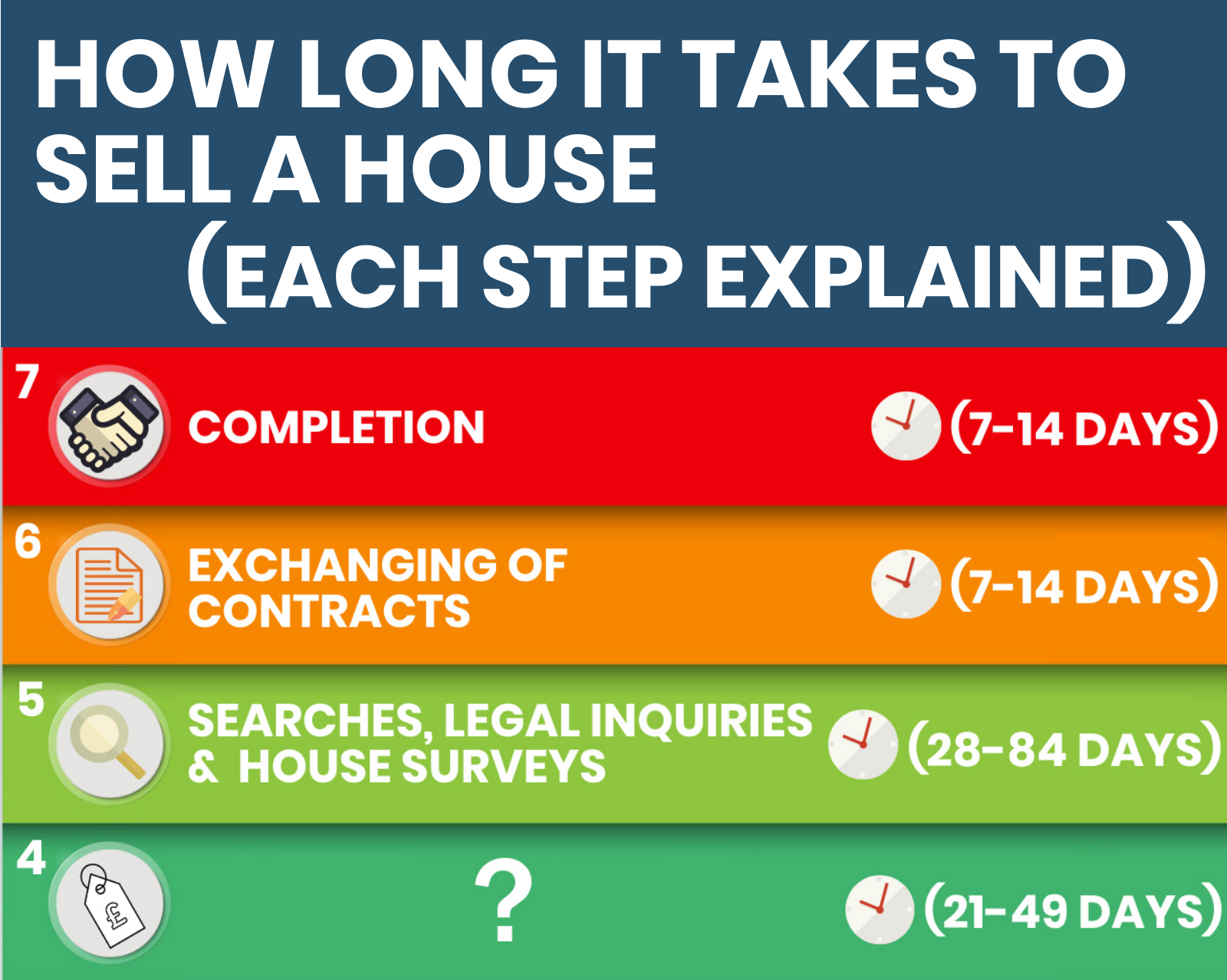

Now, let's delve into our comprehensive step-by-step guide on navigating the process of buying and selling a house simultaneously.

1. Obtain an accurate valuation for your property

Before embarking on any plans to buy or sell a house simultaneously, it is crucial to have a clear understanding of the current value of your existing home. Begin by utilizing our convenient online instant valuation tool, which provides a free estimate. Additionally, it is advisable to seek valuations from at least three local estate agents. This allows them to leverage their knowledge of the area and consider any distinctive features or home improvements that may enhance the property's value, resulting in a more precise figure. It is worth noting that some agents have a reputation for inflating valuations to secure your business. However, by obtaining valuations from multiple agents, you can minimize the risk of initially setting an asking price that may require adjustment in the following weeks.

2. Manage your finances effectively

If you're in the process of both buying and selling a house, it's crucial to have a clear understanding of your financial situation. This involves determining how much you can afford to spend on your new home and assessing the equity you currently have in your existing property.

Additionally, you need to consider the chain of transactions. When you exchange contracts for the house you intend to purchase, you'll be required to provide a deposit. Ideally, this exchange should occur on the same day as your buyer's exchange, allowing you to utilize the deposit they pay you for your own property's deposit.

However, if your new house is more expensive than your current one, the required deposit may exceed the deposit you receive. In such cases, it may be possible for your solicitor to negotiate with the seller's solicitor for a smaller deposit. If this isn't feasible, you'll need to find the additional funds. It's advisable to assess your financial capability to handle this situation before commencing the process.

Furthermore, there are other costs to consider when buying and selling simultaneously. These include stamp duty, which can usually be incorporated into your mortgage borrowing unless you're a cash buyer. It's important to be aware of this significant expense. Our stamp duty calculator is a convenient tool to help you calculate this cost accurately and efficiently.

Additionally, there will be estate agent fees for selling your property and various conveyancing fees associated with the legal aspects of buying and selling. If you require more information about these costs, you can refer to our comprehensive guides on the cost of moving house, selling your home, and buying a house.

Lastly, it's wise to allocate some extra funds in your budget to account for any unexpected challenges that may arise during the process. This precautionary measure will prevent you from stretching your budget to its maximum limit.

3. Consulting with a mortgage broker can be extremely beneficial when you are in the process of both buying and selling a house simultaneously. They can provide valuable guidance on options such as remortgaging or porting your existing mortgage to your new property.

While porting your mortgage may seem like a convenient choice, it's important to consider that exploring new mortgage options with different lenders could potentially lead to a more favorable deal. Therefore, it is highly recommended to have a conversation with a mortgage broker. However, keep in mind that if you decide to take out a new mortgage before your current one expires, there might be an early repayment charge involved.

4. Obtain your Energy Performance Certificate (EPC)

To proceed, it is essential to obtain an Energy Performance Certificate (EPC). These certificates assess the energy efficiency of properties, with the highest rating being A and the lowest being G.

Before listing your property for sale, it is mandatory to commission an EPC. Additionally, it must be readily available to show to potential buyers upon request.

It is possible that your property already possesses a valid EPC, as they remain valid for a period of 10 years. However, if this is not the case, you will need to acquire one. While many individuals opt to obtain an EPC through their estate agent for convenience, it is important to note that this option tends to be more expensive. Therefore, consider negotiating or alternatively, save yourself the trouble by arranging your own EPC independently. Local Energy Assessors in your area can assist you with this process.

5. Retrieve these essential documents

When engaging in the simultaneous process of selling and buying a house, it is crucial to promptly provide any necessary documents upon request to prevent any potential delays. Therefore, it is advisable to retrieve these documents well in advance.

For instance, when obtaining a mortgage, you will be required to present proof of identification along with documents such as proof of address. Additionally, if you are selling your property, you will need to furnish warranties for any newly installed appliances, electrical certificates for any rewiring, and records of boiler servicing.

6. Getting your home ready for sale is crucial if you want to secure the highest possible price. To achieve this, it is important to declutter your space and consider removing any large furniture that may make rooms appear cramped. Additionally, giving your house a fresh coat of neutral paint can create a brighter and more spacious atmosphere. Another key aspect is enhancing your home's kerb appeal, as our survey of over 2,000 UK adults conducted by YouGov revealed that well-maintained windows and a roof in good condition were the most important features. Lastly, consider home staging to expedite the selling process and potentially increase the final sale price.

7. Locate a real estate agent and promote the property

Afterwards, it is essential to list your current property on the market and locate a suitable real estate agent to facilitate the sale of your home. Take a look at our recommendations for finding the most competent real estate agent and utilize a tool to assess the efficiency of local agents in terms of their speed in selling properties and their success rate in achieving the desired selling price. Alternatively, you may also contemplate the option of engaging an online real estate agent.

8. Select a conveyancing solicitor

Now is the ideal time to begin searching for a conveyancing solicitor. By being proactive, they can start working promptly once you accept an offer. It is advisable to obtain quotes, speak to multiple solicitors, and read reviews before making a decision on who to instruct.

9. Reach an agreement on the sale

The duration between listing your property and receiving an offer can vary depending on factors such as location, property type, and price. Typically, it takes approximately 10 weeks from the time a home is listed until an offer is accepted. However, the current state of the UK housing market is characterized by a shortage of supply, resulting in high demand for properties, particularly detached homes. This situation works to your advantage as a seller. If you receive multiple offers, it is important to carefully consider each one. While the offered price is significant, it is also crucial to evaluate the potential buyers' circumstances. Are they reliable, motivated, and unlikely to withdraw their offer?

10. Begin your search for a new home

However, if you have experienced the benefits of selling in a seller's market, be prepared for the drawbacks of buying in one. Acting quickly and being prepared for sealed bids in a competitive property market is essential. Therefore, if you are selling, it is advisable not to delay in starting your search for your next home.

You may already have alerts set up on popular property portals such as Rightmove, Zoopla, and OnTheMarket. However, it is recommended to check these alerts first thing in the morning, especially in the current seller's market. If you are struggling to find suitable properties, enlisting the help of a Buying Agent could be beneficial. They can assist in finding properties that match your preferences and aid in negotiating the price.

11. Assess your finances and make an offer

Once you have found a property that interests you, it is important to reassess your finances. Does it fall within your original budget? Consider any potential renovation work and associated costs that may be required. Our guide on home renovation costs can provide valuable insights. After conducting your calculations and determining that it aligns with your financial plans, you can proceed to make an offer.

Being under offer puts you in a stronger position to negotiate a favorable price compared to still searching for a buyer for your current home.

This is also an opportune time to consider Home Buyers Protection Insurance. As the majority of the costs associated with moving home are borne by buyers, such as conveyancing fees, mortgage arrangement fees, and building surveys, it is wise to protect your hard-earned money. According to Quick Move Now, 32% of property sales fell through in the first quarter of 2022. Therefore, being prepared and safeguarding your finances is highly recommended.

12. Formalize your mortgage arrangements

Congratulations on having your offer accepted! However, it is important to note that there are still several steps to complete before celebrating. Begin by contacting your mortgage broker and instruct them to proceed with your full mortgage application.

13. Reach out to your conveyancing solicitor promptly

It is crucial to contact your conveyancing solicitor as soon as possible. This is especially important when you are selling and buying a house simultaneously, as the process can be lengthy and complicated. Your conveyancing solicitor will need to conduct local searches before any contracts can be exchanged when you are purchasing a property.

While the process should go smoothly, if you are not satisfied with the level of communication or the speed of the process, do not hesitate to get in touch with your solicitor. If things do not improve, you may want to consider requesting a new case handler.

There are several areas you should check, such as boundary issues, building control certificates if the property has undergone any building works, and certificates related to the installation of windows, bi-fold doors, or Dorma windows.

14. Arrange for a property survey

Your mortgage lender will require a mortgage valuation by a surveyor to ensure that the property is suitable for lending. However, this is a basic survey for your lender, and you are unlikely to see it. If you want to ensure the condition of the property you are purchasing, you should arrange for a survey.

A survey will assess the property's condition and alert you to any potential issues you may face after moving in. There are various types of surveys available, each offering different levels of thoroughness and at different costs. Unless you are experienced with property, we recommend getting a survey done.

15. Assume control of communication

Efficiently managing the process of selling and buying a house relies heavily on effective communication. It is crucial to promptly read, sign, and return any paperwork that is sent to you. Nowadays, conveyancing solicitors often utilize online systems where they can share scanned documents that you can access through a login. Take full advantage of this convenient method, but do not hesitate to reach out to your solicitor if you require clarification on any aspect of the house selling and buying process.

Communication becomes even more vital when you are part of a chain. While your conveyancing solicitor may not necessarily endorse this suggestion, it is highly beneficial to oversee communication among all parties involved when you are simultaneously selling and buying a house. To achieve this, request the contact details of the property owner you are purchasing from and the person who is buying your home, and maintain regular contact via email. If there are additional links in the chain, they can also be included in the email correspondence. This approach ensures that everyone remains informed about the progress and helps to resolve any potential obstacles that may arise during the process of selling one house and purchasing another.

16. Engage your estate agent

If you find yourself uncomfortable or lacking the time to actively facilitate the progress of the transaction, this is where your estate agent can step in to assist you when you are selling and buying a house simultaneously. Their primary objective is to guide you swiftly from accepting an offer to the exchange of contracts. According to the Property Ombudsman Code of Practice for estate agents, they have certain obligations to fulfill during this period, including monitoring the progress, providing assistance whenever possible, and relaying any relevant information that may contribute to the successful completion of the transaction. In most cases, estate agents fulfill this role competently. However, if you experience a lack of communication from your agent when you are selling one house and purchasing another, or if you feel overwhelmed by excessive communication that adds unnecessary stress to the process, it is advisable to discuss the level of their involvement with them.

17. Establish a deadline

Once all loose ends are tied up, surveys and local searches are completed, and any issues are resolved, it is time to establish a deadline for completion and exchange contracts. It is crucial for all parties involved to coordinate and agree upon a completion date that suits everyone. This will require communication between your solicitor and the solicitors of other individuals in the chain. It is important to be willing to compromise as part of the process of selling and buying a house.

18. Arrange your relocation

When selling a house and purchasing another, it is necessary to make arrangements for the provision of electricity, gas, water, and telephone services. Utilize our moving house checklist to assist you in planning your move. You may consider hiring a removals company to pack up your current residence and assist with the transition to your new home. Take a look at our guide on how to find the appropriate removals company and compare removals quotes.

19. Completion day

This is the significant day when you sell your house and acquire a new one. On completion day, funds are transferred between solicitors, and they confirm that the keys can be handed over to the new owners. The conveyancers will also register the transfers of ownership with the Land Registry.

Congratulations, you're in!